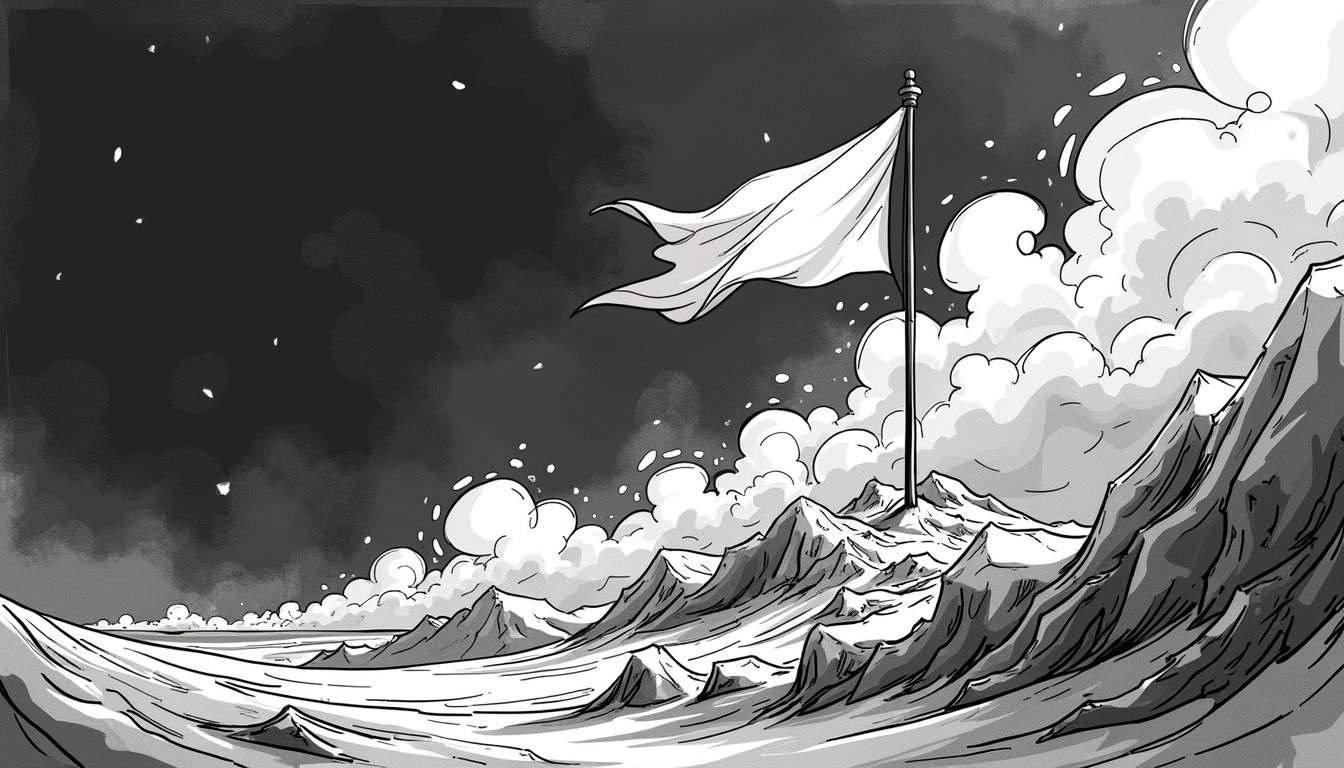

I came across this analysis about Solana and its potential breakout, and I gotta say, it’s pretty intriguing. According to some crypto analyst named Alex Clay, there’s this bullish flag pattern forming. Basically, it’s a technical thing that suggests SOL could be on the verge of a big move up. But of course, there’s more to it than just charts.

The Technical Stuff

Now, I’m no expert in technical analysis (TA), but from what I gather, this bullish flag pattern consists of two parts: a sharp upward movement (which they call the flagpole) followed by a consolidation phase. When the price breaks out of that consolidation area, it usually means the upward trend is continuing.

Clay has identified some key resistance levels too. There’s one around $220 that SOL is currently testing. If it breaks through that, he thinks we could see some serious upward momentum. He’s even got two price targets in mind: one at $391 and another at an ambitious $621.

Fibonacci Levels

And then there’s this whole Fibonacci extension thing going on. Apparently, these are popular tools in TA used to predict potential price targets based on previous movements. They can be useful but also risky since they don’t account for sudden market changes.

Beyond Charts: Solana’s Ecosystem

But here’s where things get interesting for me as someone who dabbles in online crypto sports betting: it’s not just about the technical indicators or even about whether or not to bet on crypto based on those indicators; it’s also about Solana itself and what makes it tick.

For instance, did you know that Solana’s network is getting some serious upgrades? They’ve got new validator clients that are boosting performance and scalability like crazy. And when a network becomes more efficient and cheaper to use? Yeah, that usually attracts more users and developers—and subsequently pushes up demand for SOL.

Institutional Interest

Then there’s the whole institutional angle. Apparently, financial institutions are starting to flock to Solana because of its low fees and fast transaction speeds. If big money starts pouring in, you can bet (pun intended) that retail investors will follow suit.

The Betting Angle

As someone who uses crypto betting platforms regularly—especially those offering crypto soccer betting options—I’m always looking for ecosystems where my betting dollars might have a better return down the line.

Solana seems to be positioning itself as a heavyweight player in the blockchain space with all these developments going on—so maybe now’s not such a bad time to place some bets?

Final Thoughts

Of course, nothing is guaranteed in this volatile space we call crypto—especially when it comes to sports betting recommendations based solely off one analyst’s opinion—but there’s definitely something brewing with SOL.

Whether you’re looking at it from an investment standpoint or simply as another layer added onto my existing online crypto sportsbook stack—I think I’ll keep an eye on things as they develop further!